- Home

- gain the

- What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

4.5 (496) · $ 16.50 · In stock

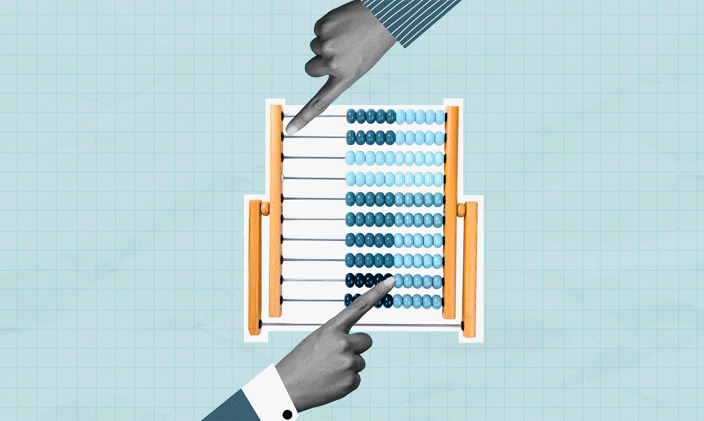

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Currency Exchange Gain/Losses

ZarMoney vs FreshBooks vs Zoho Books: Detailed Review

An OeDBTR illustration of ontology primitives of a business

Accounting for Foreign Exchange Transactions - Withum

What Is an Accountant?

Three common currency-adjustment pitfalls

Oracle Payables User's Guide

Papaya Global Review & Analysis – Is It a Legit EOR?

Advanced Accounting Foreign Currency Transactions

FINANCIAL ACCOUNTING FINAL EXAM

Foreign currency translation vs remeasurement- Exchange rate sim

What Is a Savings Account? - NerdWallet

Volume 14 Number 3 (July to September 2003) - University of the

What types of journal entries are tested on the CPA exam

Marty Zigman on Learn How To Craft Better NetSuite Financial