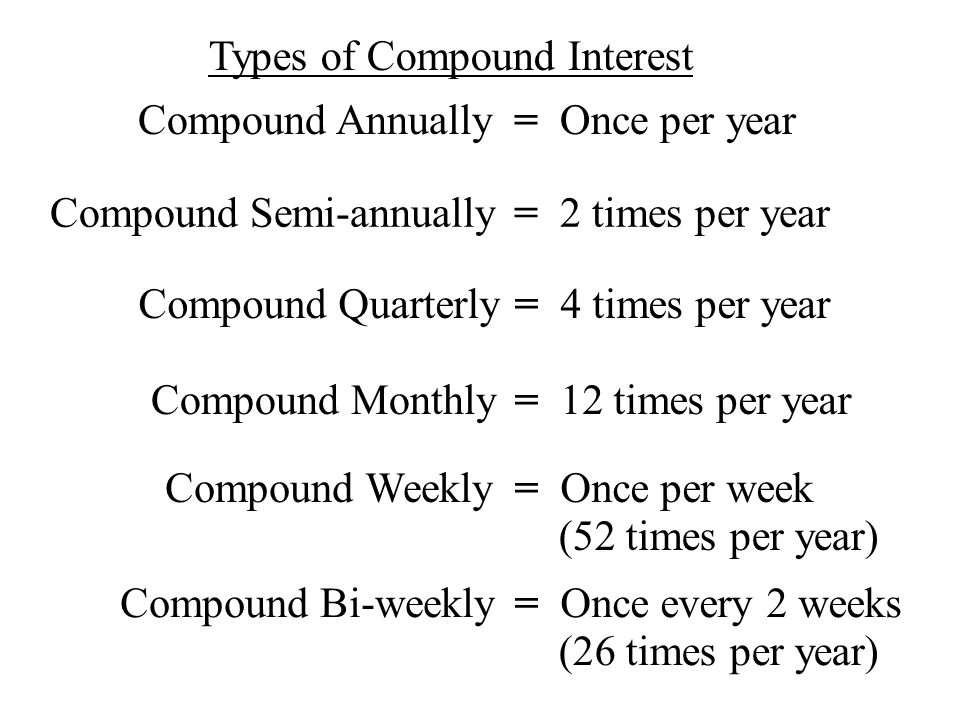

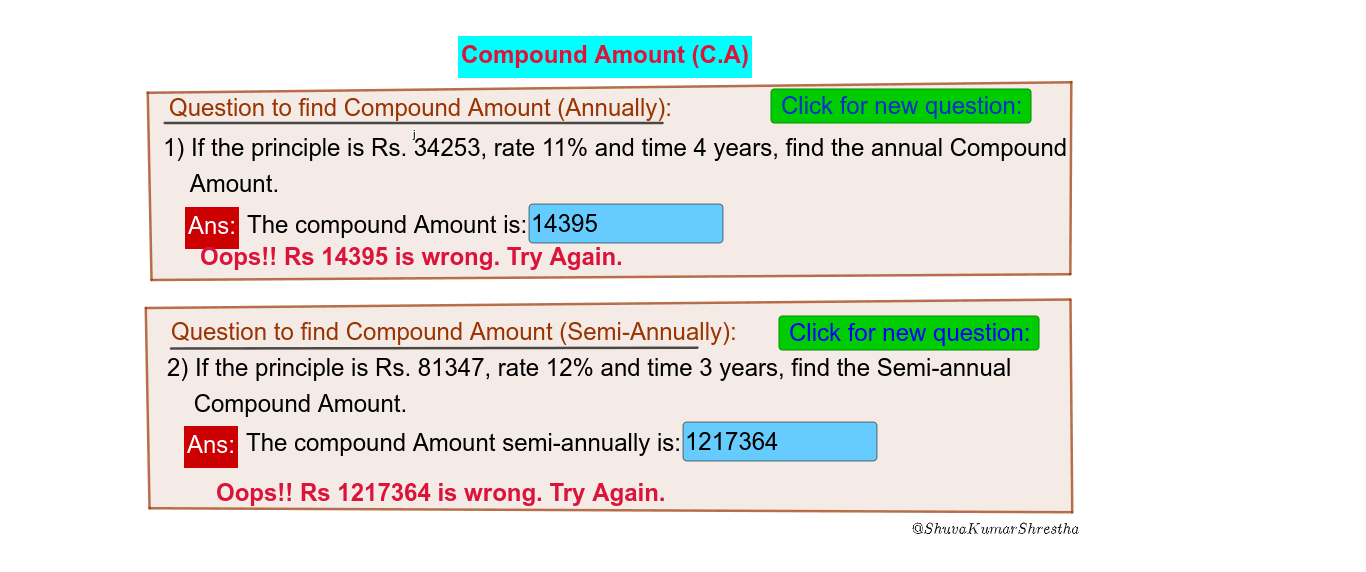

The annualized, semi-annual, monthly and weekly volatilities over the

4.6 (405) · $ 20.50 · In stock

Risk Statistics - SAYS Platform Help

Choosing Between Weekly and Monthly Volatility Drivers Within a Double Asymmetric GARCH-MIDAS Model

SAS Weekly Bund Yield Forecast, February 23, 2024: Negative 2-Year/10-Year Spread Probability Rises Again to 68.5% in August - SAS Risk Data and Analytics

Conditional heteroscedasticity estimates motnhly series

The annualized, semi-annual, monthly and weekly volatilities over the

Full article: A subdiffusive stochastic volatility jump model

Annualizing volatility

Conditional heteroscedasticity estimates motnhly series

SAS Weekly Forecast, February 16, 2024: 18 Trading Days from a Record Negative Treasury Spread Streak - SAS Risk Data and Analytics

How to trade Stock Options using Data Science and AI techniques — Making Passive Income Part 2 (Volatility), by Abdalla A. Mahgoub, MSc / CISI, CodeX

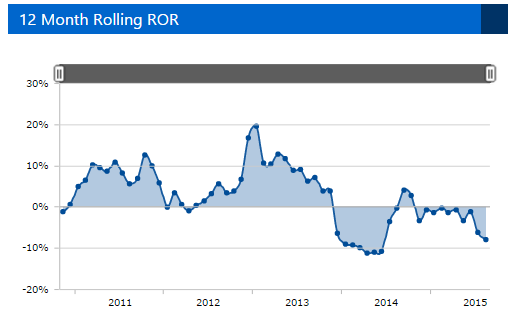

Volatility chart (12 months rolling)

The annualized, semi-annual, monthly and weekly volatilities over the

Compound Interest Calculator: Daily, Monthly, Quarterly, Annual (2024)

Conditional heteroscedasticity estimates annual series

Trajetória média do peso de bovinos Indubrasil, desde o nascimento até