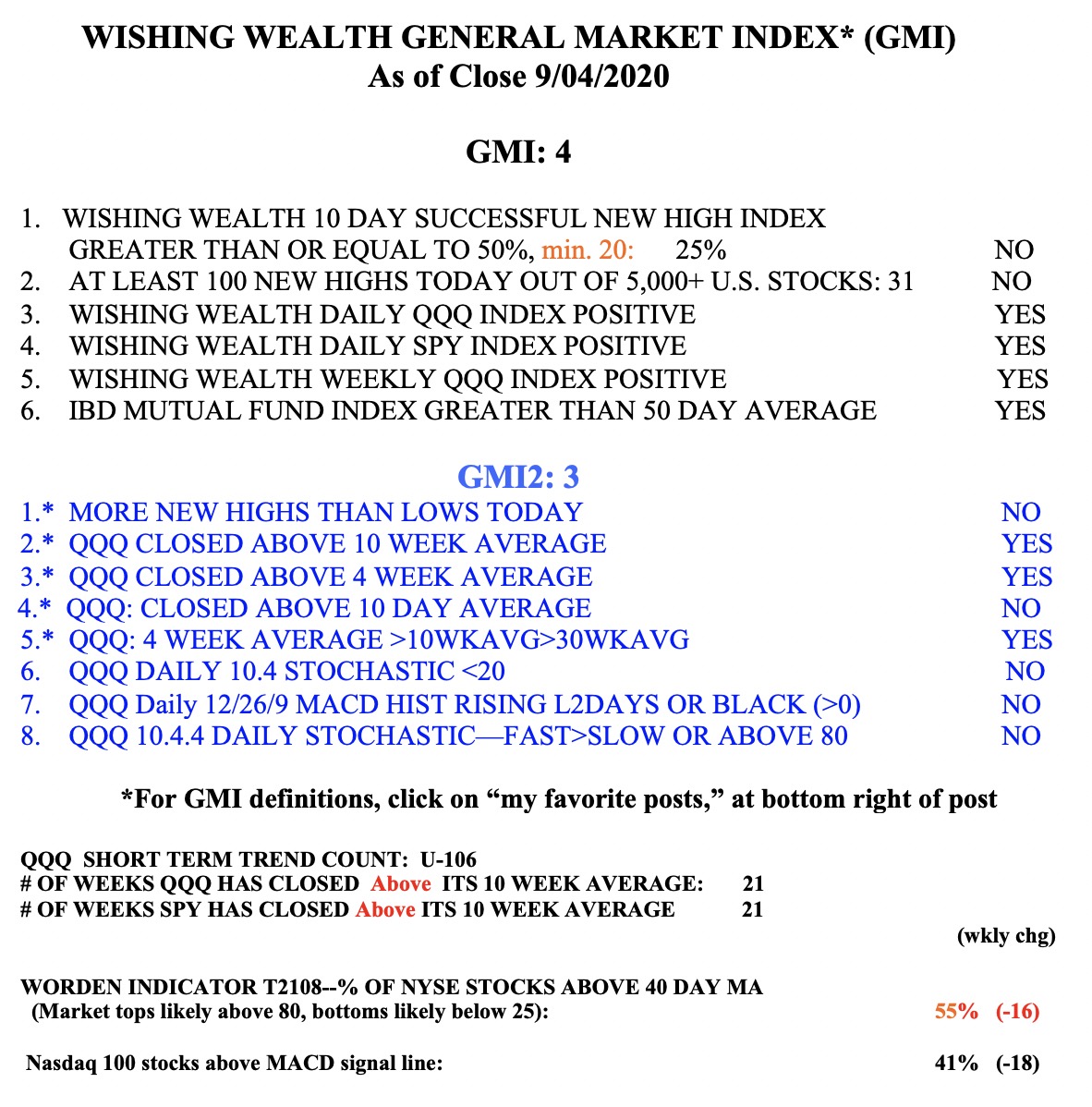

Blog Post: Day 41 of $QQQ short term up-trend, GMI declines to 4

4.6 (326) · $ 20.50 · In stock

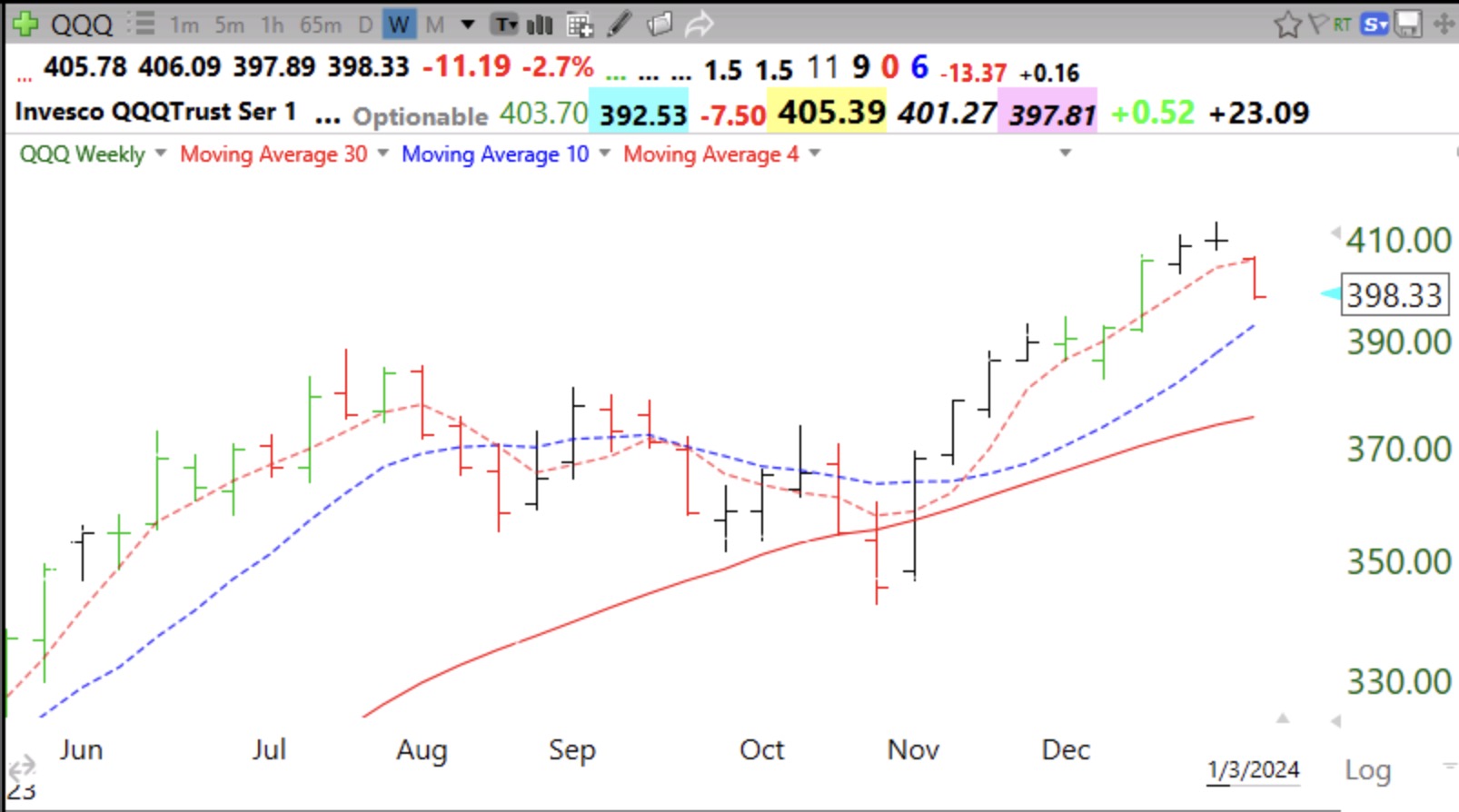

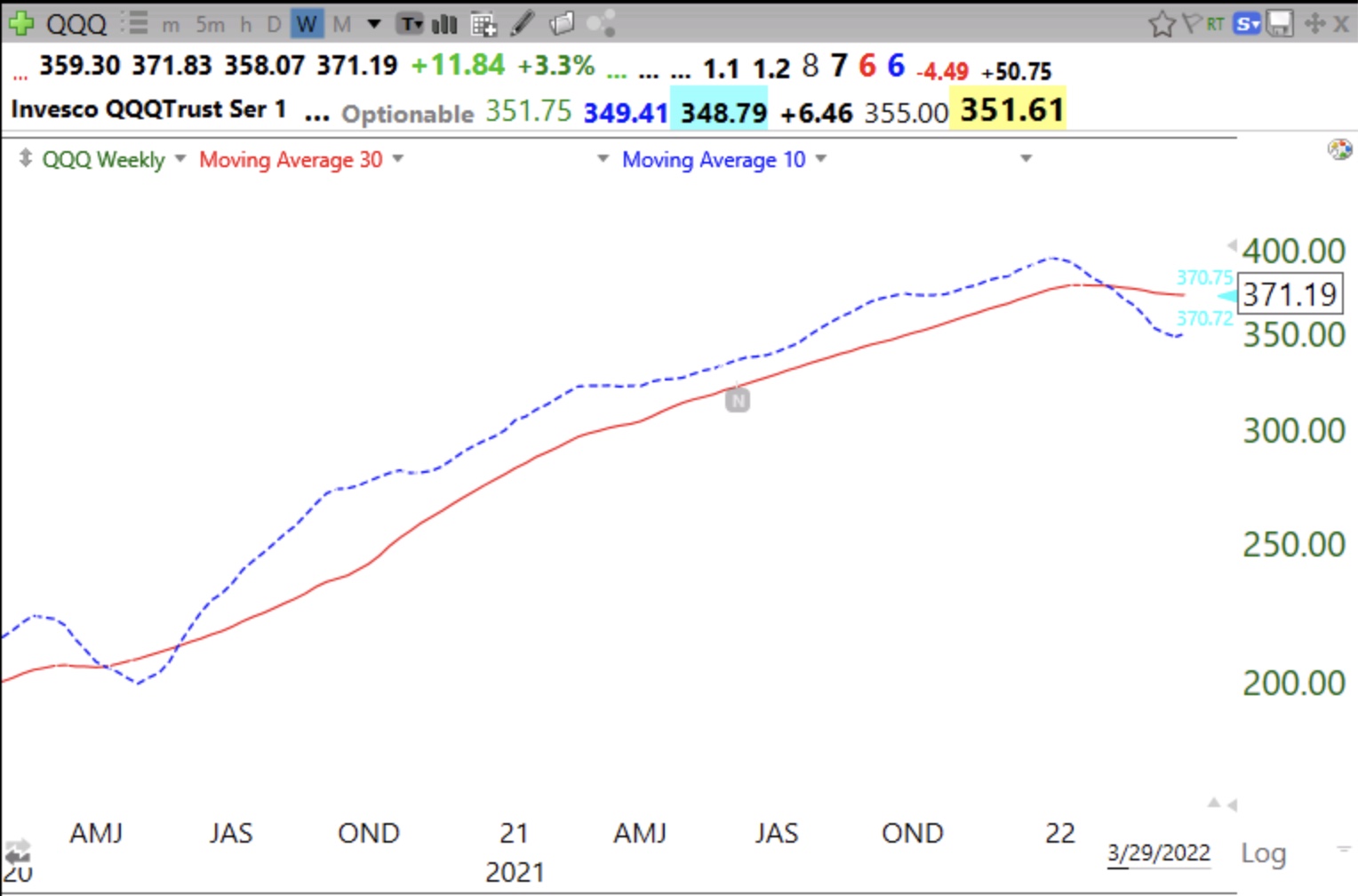

A stong advance is evident when the 4wk>10wk>30 average and the stock continually climbs above the 4 wk average. It is clear from this chart that QQQ is now below the 4 wk average (red dotted line). If it closes the week below, it suggests to me that the recent up-trend is over for now.

QQQ ETF: Buy For The Trend Reversal (Technical Analysis)

Blog post: GMI= 6 (of 6) and Day 8 of $QQQ short term up-trend; 10/30 weekly naked chart reveals index and stock trends

New freshmen class and possible online workshop! How I use Bollinger Bands and how this indicator foreshadowed this decline; Just a brief shake-out? Short and long term trends of the market remain

Gap Up Again! QQQ approaches Highs

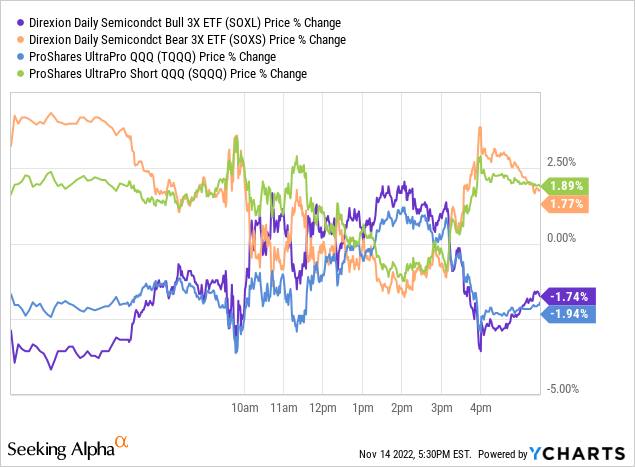

SQQQ, TQQQ: Leveraged ETFs Can Be A (Short-Term) Home Run Or A (Long-Term) Loaded Gun

GMI flashes Red signal and IBD calls “Market in Correction”; Promising recent GLBs: $PINS and $LOB

Pullback Imminent For Nasdaq 100: Outlining Four Potential Scenarios For The QQQ - Netflix (NASDAQ:NFLX) - Benzinga

Time-frame selection for qqq day trading systems - Simple stock trading

Pullback Imminent For Nasdaq 100: Outlining Four Potential Scenarios For The QQQ - Netflix (NASDAQ:NFLX) - Benzinga

Investing Money Blogs: HOW DOES THE STOCK MARKET WORK?

GMI: 5; IBD 100 stocks outperform

Junior Nasdaq Beating QQQ Again as Low Volatility Draws Risk Takers Away From Apple