Lines 33 - 36 Center for Agricultural Law and Taxation

5 (455) · $ 12.50 · In stock

Farmers total all expenses reported on Part II of the Schedule F and report the total on Line 33, Schedule F. Example 1. Georgia has $652,435 of total allowable farm expenses this year. She reports this total on Line 33, Schedule F. Net farm profit or loss is reported on Line 34, Schedule F. This is calculated by subtracting Total Expenses (Line 33, Schedule F) from Gross

Revised GST Slab Rates in India F.Y. 2023-24 by Council

Sustainability disclosures gain momentum among Latin American issuers

Carbon emission trading - Wikipedia

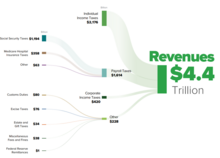

Taxation in the United States - Wikipedia

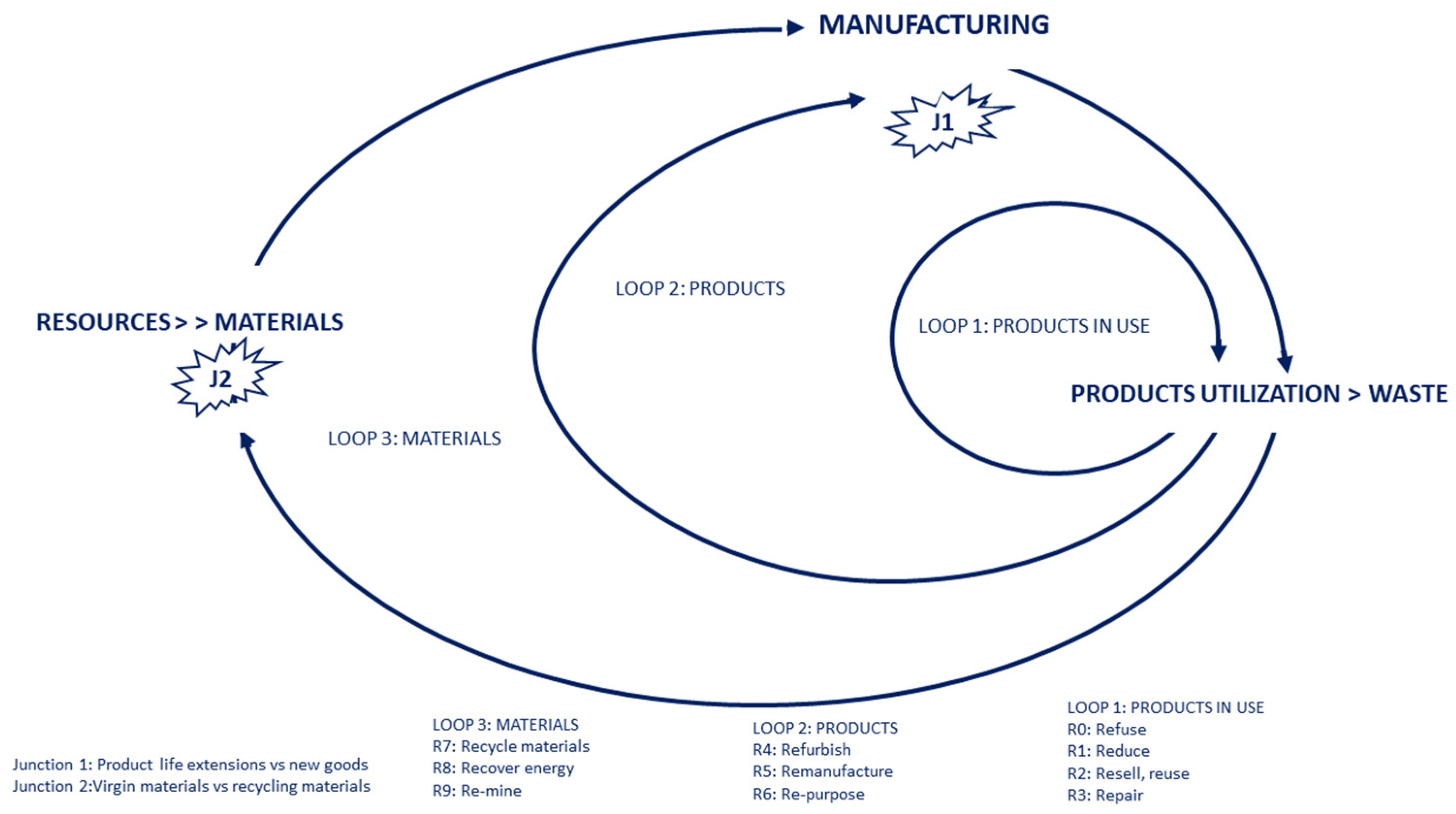

Sustainability, Free Full-Text

Sustainability, Free Full-Text

Promoting Climate-Resilient Agricultural and Rural Credit - Center

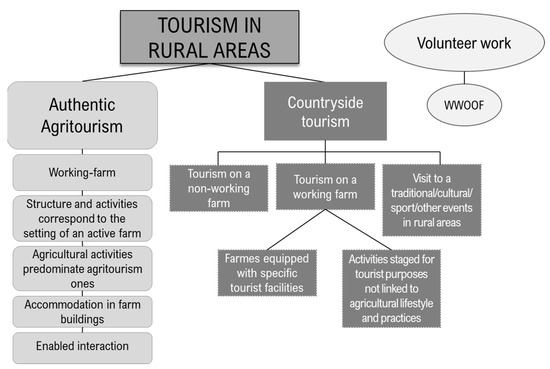

Land, Free Full-Text

Riot Platforms: The Company Behind the Most Energy Intensive Bitcoin Mine in the U.S. - Greenpeace USA

Framing and Themes of the City of Boulder's Sugar-Sweetened Beverage Tax Coverage in the Local News From 2016 to 2018 - AJPM Focus

Watch Bloomberg Markets: Asia 03/01/2024 - Bloomberg

Sustainability, Free Full-Text

Sustainability, Free Full-Text

Center for Agricultural Law and Taxation